Credit Card Hardship: How to Ask For Help

Americans hold at least $6,000 in credit card debt on average. And while credit card debt is considered “unsecured” debt, it can wreak havoc on your credit report if you miss a payment.

Whether you’ve lost a job or are just trying to make ends meet, there is a light at the end of the tunnel.

If you’re struggling to repay your credit cards, you could qualify for a credit card hardship program. Read on to learn more about this program and how it might be able to help you.

What is the Credit Card Hardship Program?

Depending on the issuer, your credit card company may offer a special program to help you during times of need. This program is designed to help temporarily reduce your monthly payment amount until you can get back on track.

In most cases, the program will last for a minimum of six months to a maximum of one year. During that time, you’ll still need to make your payments on time, but the required amount will be lower.

You may even be able to waive certain fees like late fees and over-charge limit fees depending on the company. The goal is simple: you get a break, and your card issuer still gets paid.

In order to enroll in this program, there are certain guidelines you’ll need to follow, but it’s a wonderful way to reduce your stress while salvaging your credit score.

Examples of Hardship

When it comes to financing and debt, there’s a myriad of reasons you could be falling behind. The most common reason is job loss. When you lose your income, of course, you’re going to lose the ability to pay certain bills.

Another example of hardship may include a serious illness or an injury. During those times, you may not be able to work, and you’re likely accruing some large medical bills, too.

A death in the family and even a divorce are also common forms of financial hardship. When you lose someone, you are not only struggling emotionally but likely financially.

Finally, another common cause of financial hardship is coping with a natural disaster. If you’re a victim of a storm, flood, or fire, you are probably struggling to maintain your financial obligations.

What to do Before You Enroll

A credit card hardship program can be helpful, but it may also impact your finances negatively in other ways. Before you decide to enroll, sit down and create a budget.

Take a close look at areas where you might be able to cut back such as your cable bill or your cell phone data plan. By shaving off a few dollars here and there, you might be able to make up for it and pay your card’s monthly minimum without a problem.

If you’ve become ill or injured, consider supplemental insurance that can pay you for time lost at work. Really think about the timeline of your financial hardship and how long you think it will last. This will help you when you call to enroll, as most issuers want to know how long to expect lower payments.

Click Here to learn more about credit repair.

When You Call

It’s important to note that most customer service reps may not be familiar with their company’s hardship program. When you call, simply ask if they offer one and if you could get some more information.

Some credit card companies will worry as soon as you mention your inability to make payments. Never tell them that you’re “unable to pay,” but instead just ask about the terms and guidelines of the plan.

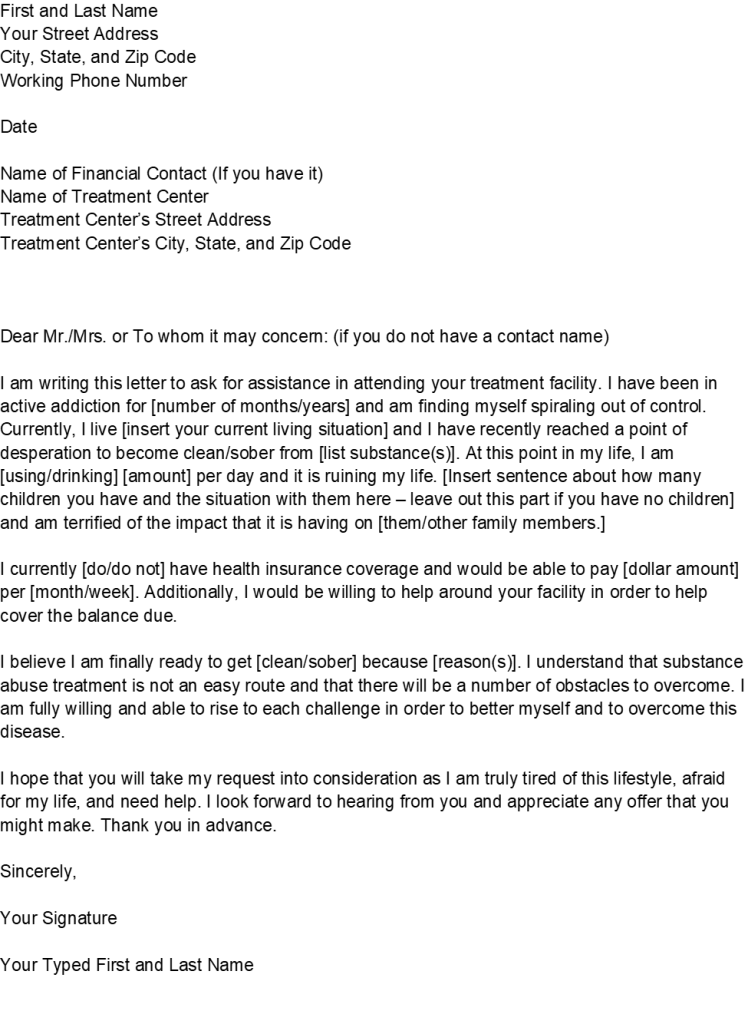

It could take some time for you to decide whether the plan is worth it, so getting the fine print in your hands is the best way to start. After you’ve read all the documentation, you can submit a hardship letter.

Make sure you clearly and thoroughly explain your situation along with a timeline of how long you’ll need to be enrolled. Make sure you tell them exactly what amount you can reasonably pay each month. This number is key to ensuring you get a fair deal.

Understanding Terms

Once you’ve determined your desired payment and timeline, it’s time to submit your information to the credit card company. Keep in mind that not all issuers will accept your initial request.

Depending on the number, the credit card company may determine that your desired payment is too low. In this case, they’ll either submit a counteroffer with a new payment amount or decline your application.

Always emphasize your willingness and desire to repay your debt. Tell the credit card company you will stick to the timeline and once it’s over, you’ll be able to go back to your normal monthly minimum.

You should also find out if participating in this program will hurt your credit or not. Some companies may allow forgiveness and it won’t impact your score. On the other hand, they may require you to close the account altogether.

If you are forced to close your account, you’ll still need to make the payments or you run the risk of a “ding” on your credit report. If you have to close an account, it will hurt your credit, but it’s still better than being hit for nonpayment and collections.

There is Hope with Hardship Programs

Although it may not seem ideal, a credit card hardship plan can be extremely helpful in times of need. Do your homework and try to find ways you can cut your expenses to save money. As a last resort, these programs can help you maintain your good credit in the short-term.

For more information about writing a hardship letter, be sure to visit our website.