Treatment Center Hardship Letter

Have you given up on the idea of ever attending a substance abuse treatment center because of the overwhelming cost? You’re not alone, but there is one secret that most people aren’t aware of. That secret is called a treatment center hardship letter. A hardship letter is one that’s written to the addiction center(s) you select. It asks for help in covering the costs associated with your treatment. Each treatment facility’s funds are limited to what they can provide, either out of their pocket or from state or federal grants.

The granting of hardship letter funds doesn’t guarantee you will receive inpatient or outpatient treatment, nor does it promise completely free treatment. Many times, it only covers a partial payment of your out-of-pocket costs after your insurance is billed. If you don’t have insurance, try sending a hardship letter to request a full or partial scholarship to the facility. It’s also worth noting that facilities don’t extend scholarships or discounts to offset your income if you must miss work. Nor will they help with your monthly household bills. You must come up with a plan to have those bill met while you’re in treatment or consider other options. The good news is that any financial help can get you one step closer to getting help for your addiction!

We’re going to discuss when and how you should write a hardship letter to an addiction treatment center. That is, if you feel it’s the best way forward based on your financial circumstances. We will also give you a template that you may use for this very purpose. Keep reading to find out everything you need to know about overcoming any financial cost barriers to treating your addiction!

Why You Might Consider Writing a Treatment Center Hardship Letter

It may seem as though everyone should write a hardship letter to receive discounted or free treatment. However, some specific circumstances receive more positive results than others. These circumstances include, but aren’t limited to when the patient is homeless, has no family to turn to, or if there are children involved.

Additionally, young adults without health insurance may be eligible for reduced rates if their letter conveys a strong desire to get clean or sober. Just remember, it’s important that you’re honest and forthright because you probably only have one chance per treatment center for this letter to work!

Information Your Treatment Center Hardship Letter Should Contain

One of the hardest parts of writing a hardship letter will be setting your pride aside. You will have to be honest about your financial situation, as well as how you’ve gotten there. Not only will you need to talk about your finances, but you’ll also need to discuss your addiction, the negative effects it has on your life, and why you’re ready for help. This does not necessarily mean telling a sob story or trying to make the reader feel bad for you. It’s simply to inform the treatment center of the reasons why you believe you’re eligible for financial help.

What you are trying to do is convey that you’re willing and able to accept some difficult truths about yourself and your addiction. You may want to talk about some of your future goals after treatment, especially if it includes your children. Ultimately, if you you’re not truly ready to get clean and sober, the reader of your letter will likely sense this. You must be ready for a change and commit to doing whatever is necessary. This often means facing loved ones, confronting old hurts and mistakes, and being willing to take suggestions. Some of the best pieces of information to include in your letter are:

- Your current living situation

- Drug(s) of choice and how much you’re using

- Whether or not you have children who are reliant on you as a parent

- Any possible insurance coverage

- Potential payments that you can afford

- Why you need to get clean

Show the treatment team that you’re willing to do whatever is necessary to change your life and get clean!

Don’t Ask for a (Completely) Free Ride

While you may not have all the money you need to pay for your treatment, there are other ways that you might consider “paying.” You may wish to include in your hardship letter that you would like to work out a financial payment plan. This payment plan would be an amount you can afford monthly or weekly beginning during or after you graduate treatment.

Making this offer in your letter shows that you aren’t just looking for an “easy” financial out. Instead, you understand the gravity of your situation. Instead of repaying the treatment center financially, you may also ask if there is work that you can do. They may need help maintaining the grounds or the inside of the treatment center while you’re there. You can also promise to lend a hand upon the completion of your program.

Getting the Answer You Want

Writing a hardship letter doesn’t necessarily mean that you’ll receive a full scholarship to a treatment center. You may have to send your letter to several facilities to obtain even one “yes.” One of the hardest parts about knowing who to send your letter to will be finding an addiction treatment center that will consider it.

While there are thousands of treatment centers in the United States, not all of them follow the same hardship help protocols. After you send your letter, you will need to follow up. In fact, for the best probability of positive results, you will need to be persistent. This will also demonstrate to the facility that you’re serious about recovery and are ready to pursue it!

Honesty, Openness, and Willingness

If you’ve been through treatment before, you’ve heard the phrase “honesty, openness, and willingness.” If you’ve never attended a treatment program or participated in support meetings, it is probably new to you. Either way, the first letter of these three words spell out HOW. Each word is practical when it comes to getting and staying clean or sober. You should apply this mantra when writing your hardship letter.

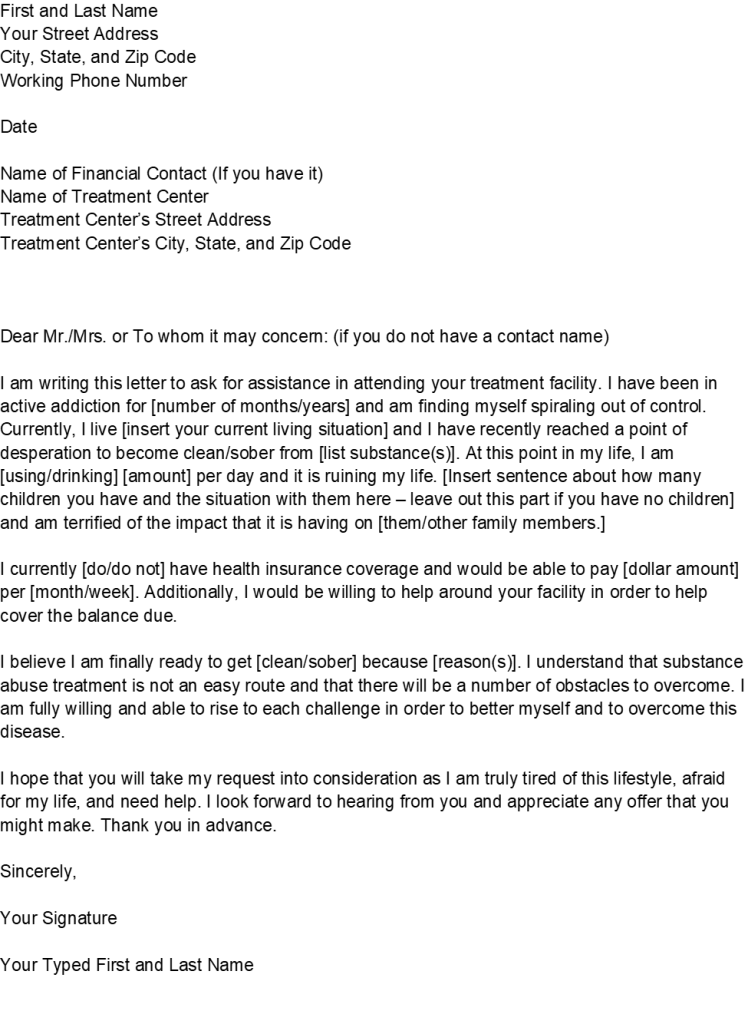

Demonstrate honesty about your addiction and the need for help. You must be open about where your life is and how it got there. Finally, you need to be willing to do whatever it takes to get sober, including owning up to your previous mistakes and confronting your past. If you need further direction, check out the sample treatment center hardship letter below, courtesy of Real Hope Recovery.